Land – the secret to selling

If you do not already know this, the secret to selling is to objectively evaluate what you have relative to other sold offering’s then price yours competitively, or not, and wait with hope – though you will realize the longer you wait the more of a discount your asset will likely trade relative to the open marketplace.

According to BAREIS, as May concluded, Sonoma County had exactly 514 non-commercial parcels on the open market – 76 of which were newly exposed to the market during the month. Our County saw 38 sites receive accepted offers during the period while another 47 parcels formally traded hands – at a median value of $235,000 – well above the fifteen-year running average of 20 sales per month. This indicates a strong demand for the most appropriately priced plots, though the increase in interest is overshadowed by the consistent supply of new lots being brought to the market as the chasm between sold and available properties is expected to widen as this year progresses.

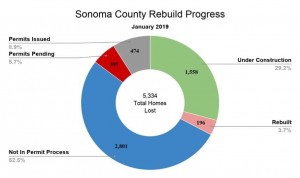

Specifically, within Sonoma County, Santa Rosa’s Northeast quadrant has been the primary catalyst for the increased activity levels. The Tubbs fire has reshaped the landscape and the marketplace as we know it. The region was showcasing 198 residential lots on the open market as we wrapped up May. New offerings from sellers accounted for 30 of those during this period with buyers promptly capturing 17 new contracts on parcels – well above the historical average of two per month. Sellers completed an additional 25 sales during the period and, since the fires, have sold a total of 423 parcels – accounting for half of all non-commercial lot transactions in Sonoma County. To put this in perspective, Northwest Santa Rosa has sold a total of 152 lots since November 2017 while the greater Sonoma Valley region has seen only 46 transactions. Sellers of lots should be readying them for market by making final clearings of dead or diseased vegetation and, if not for their determination of holding their sites for years to come while trying to allow the natural beauty to return, to at least abide by county ordinances that require such abatement in order to limit further fire dangers to the surrounding areas – by the way, this is required every year to be completed by July whether you have a home on your site or not, and if not completed, it will be done for you at a rather exorbitant cost of which you will receive a bill for.

As the volume of offerings and transactions stack-up we see measurable data points appear. In Northeast Santa Rosa, the average price paid for a lot in May was $279,000 while the median price hovered at $250,000 – median is the midpoint of all sold properties whereby half sold for more while the other half sold for less. In a market as liquid as we are encountering, even though the average number of days to sell a parcel rose to 151, the only thing keeping the dirt from transacting is the price being asked by the seller. This is a common theme in basic economics – a seller sets a price, but a buyer establishes the market value.

Annualized data gives us a solid perspective on the marketplace. It tells us that there have been significantly more sellers in the Northeast Santa Rosa markets defined as “Mark West” and “Fountaingrove” than anywhere else. This is attributable to a myriad of reasons: the cost to build in this region due to site slopes and soil conditions makes it exceptionally more expensive, the logistics for positioning labor and supplies on each lot absorb more of the total construction dollars than in Northwest Santa Rosa and the general age of the population was more senior and thus more reluctant to place the time, energy and money into rebuilding at this stage of their lives.

Along with this, as more parcels make their way to market, another metric comes into play – the elasticity of demand. This is the measure of the change in the quantity demanded or purchased in a product – vacant land in this case – in relation to its price, or required adjustment of such, so that it finds a willing and capable buyer.

Each month adds to the charted progress within our markets as we anticipate values on lots to be more closely associated with the effective price of the newly built home that rises in its place. A rule of thumb typically used by investors is that not more than 15-20 percent of the value of the total combined asset can be assigned to the underlying cost of the dirt. Thus, for a new $1,000,000 home to come to life, a builder or investor should be reluctant to pay more than $150,000 – $200,000 for the lot the home will sit on unless there cost to build is uncharacteristically below market metrics. With the rising costs of construction, these market forces may diminish the value a willing buyer may place on the parcel they are seeking – moving forward, expect lot prices for most sites to continue to fall in line with market requirements before being transacted on.

Perplexed about what to do with your property, we have your answers and your buyers.